Sensex hits record high! These 20 stocks surged 30-99% in 5 months

Rusmik Oza of Kotak Securities said breaking the last two years' trend he can expect mid & small-caps to outperform the Nifty/Sensex in the next one year because of their beaten-down nature and valuations.

Investor sentiment seems to have turned positive again as the Sensex climbed back to mount 40,000 after nearly a five-month break and hit a new record high of 40,345.

Slowdown worries, weak earnings in June quarter, FII selling, NPA concerns among other factors ruined investor confidence and dragged the index to 36,100 levels, on an intraday basis, from the peak of 40,308 on June 3, 2019.

The massive correction got the acknowledgement of the government, which introduced a slew of measure to revive the economy, as well as, earning of the India Inc. In the two months after touching the low of 36,100 levels on August 23, the index gained more than 3,900 points.

The market generally factors in all the positive and negative news sooner rather than later. Hence, one could say that the current rally is on optimism that the economy could recover from the second half of FY20 on the back of a good festive season and in line to better-than-expected earnings in September quarter.

But looking at the stock price data, the "hope rally" was driven only by few stocks and it was not a broad-based run. In fact, the BSE Midcap index fell 3.3 percent and Smallcap index dropped 10 percent in nearly five months.

However, a closer look at the data reveals that this "hope rally" was driven by only a few stocks and was not broad-based. In fact, the BSE Midcap index fell 3.3 percent and Smallcap index dropped 10 percent in nearly five months.

In the five months, it took to reclaim Mount 40k, little more than 30 percent stocks in the BSE500 index were in positive terrain.

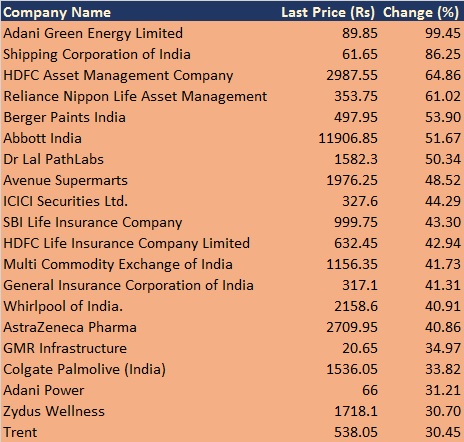

Among those 30 percent, around half of stocks gave double-digit returns, of which, the top 20 stocks rallied between 30 percent and 99 percent.

Adani Green Energy, Shipping Corporation of India, HDFC AMC, Reliance Nippon, Berger Paints, Dr Lal PathLabs, Avenue Supermarts, ICICI Securities, SBI Life, HDFC Life, MCX, GIC Re, Colgate etc were among those 20 stocks.

However, on the other side, more than 200 stocks fell double-digit with top 35 stocks declining over 50 percent which included most of the companies that faced high debt, corporate governance, asset quality concerns etc.Coffee Day, DHFL, Lakshmi Vilas Bank, Vodafone, Yes Bank, Dish TV, RBL Bank, Edelweiss Financial, Indian Bank, Indiabulls Group stocks etc included in the losers list.

If we see the Sensex also, the rally was driven only by top 5-6 stocks which included Bajaj Finance (up 13 percent), ICICI Bank (12.4 percent), Reliance Industries (9.4 percent), HUL (19.4 percent), Asian Paints (28 percent) etc.

On the losing side, Yes Bank fell the most, down 63 percent followed by Tata Steel, Coal India, IndusInd Bank, SBI, ONGC, Infosys etc which lost 10-22 percent.

The rally is likely to be broadened once the actual results of these government measures start kicking in with full force in terms of earnings and economic growth and the underperformance of mid-small-caps in last 18 months indicated that all negatives already priced in, experts feel.

"We believe the last few quarters were very tough for the overall market. The sectors such as auto, energy, metals and so have seen good correction barring few stocks. Auto space has seen its worst quarters in terms of volume and growth in the last few years while on macro-level GDP is slowest in the last few years. So that does somewhat indicate all the negative sentiments are priced in," Nadeem, CEO, Epic Research told Moneycontrol.

However, important barometers for growth such as low-interest rates, India's position among fasting growing economies, stable crude oil prices, all these were the positives to see, he added.

"The corporate tax cut is one such decision which has changed the dynamics for a very long term. So amid all the negative news markets may have seen pricing in of negative news," he added.

In fact, most experts believe the Samvat 2076 is expected to be strong as they expect a double-digit return on the benchmark indices followed by broader markets. If the global cues remain supportive then there could be a bigger run, backed by FII flow, experts feel.

"The recent shift in the Indian financial system (cut in tax and interest rate) is going to have a longer-term impact on these indices (Midcap and Smallcap). While Nifty or benchmark is driven lately only by a handful of stocks with a major concentration and also there is a divergence of the benchmark with other indices. So that should erode as time passes and we will see outperformance from small-cap and midcap space in next 1 year or so," Nadeem said.

Rusmik Oza, Head of Fundamental Research at Kotak Securities also said breaking the last two years' trend he can expect mid & small-caps to outperform the Nifty/Sensex in the next one year because of their beaten-down nature and valuations.

"Post the recent tax cut, investors interest in broader markets should revive gradually as earnings could improve with immediate effect while revenue growth could come with a lag of one or two quarters. Many mid & small-cap companies have deleveraged their balance sheets and the recent tax cut could enhance their Return of Equity (RoE). This should help in improving valuations for many companies which have been paying full tax rate. Given current sentiment and high perceived risk towards corporate governance issues, it is best to avoid poorly governed mid & small-cap companies with a question mark on financials," he reasoned.

In the BSE Smallcap index, only 150 stocks out of more than 800 traded in the green, of which top 40 stocks gained 20-99 percent including Religare Enterprises, Ion Exchange, Ashapura Minechem, Vadilal Industries, INEOS, Prabhat Dairy, RITES, Bata India etc.

Sorce by - Moneycontrol

Professional Advisory For Help And Support- AllianceResearch

Comments

Post a Comment